IT majors scout for engineering firms!

IT companies

are acquiring

engineering services firms

to expand their range of competencies and compete with pureplay engineering services companies backed by well-funded private equity firms.

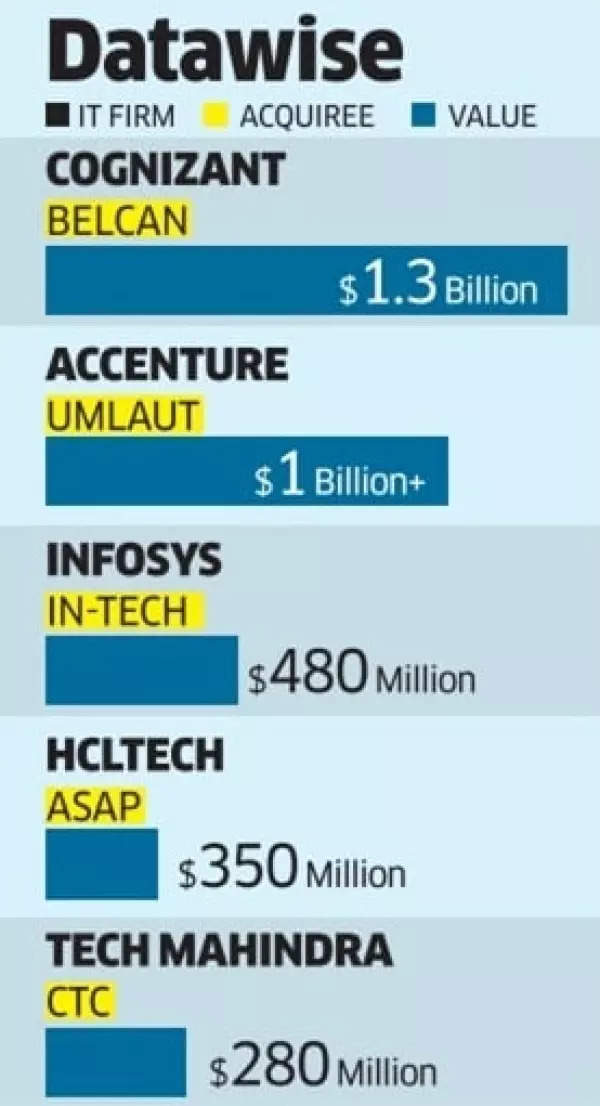

Cognizant recently made its largest acquisition in the engineering space, purchasing US-based Belcan for $1.3 billion. This marks Cognizant’s second engineering acquisition under new CEO Ravi Kumar’s leadership.

According to an ET report, other IT companies have also made notable acquisitions in the engineering services sector.

In April,

Infosys

made a significant acquisition by purchasing in-tech, a German company specializing in ER&D, for a sum of $480 million. This move was preceded by another notable acquisition in January, where Infosys acquired InSemi, a provider of semiconductor design and embedded services, for Rs 280 crore ($33 million).

Datawise

HCLTech acquired German automotive engineering firm ASAP last year for $280 million. Accenture, Capgemini, Tech Mahindra, Coforge, and smaller players like Happiest Minds and Xorient have also made acquisitions in this space recently.

According to analysts, there is significant untapped outsourcing potential in the engineering services sector.

Pareekh Jain, chief executive at EIIRTrend, was quoted as saying, “Only 20% of the 5% of total ER&D spend comes to India. This is expected to grow 3x in next ten years. Engineering services seems to be now at a place where IT services used to be 10-15 years ago. IT firms are jumping on to the bandwagon of growing ER&D spend.”

Also Read | Sunil Bharti Mittal recalls how an ‘inspiring’ meeting with PM Modi was a turning point for Airtel

Jain also added that IT companies aim to offer comprehensive solutions because digital services have a significant engineering component. Without augmenting their capabilities, IT firms risk losing engineering work to smaller pureplay engineering services companies, which are currently growing faster than their larger counterparts.

Jain highlighted an additional reason contributing to the increasing M&A activity in the engineering sector. He said, “Of late many PE firms have started investing in pure play engineering firms. About 20 of them are now being backed by top PE firms. This has also raised the heat faced by IT service providers.”

Also Read | Higher utilization & GenAI at work? Why bench strength at top Indian IT outsourcers has nearly halved

Private equity firms generally make investments with the intention of divesting their stakes after a certain period to generate higher returns. The growing interest from PE firms in engineering companies indicates the significant value and potential within this industry.