New rules for tax saving fixed deposits soon?

State Bank of India

, along with other public sector lenders, are appealing to the government to permit them to offer incentives aimed at bolstering deposits. The drop in deposits has affected the flow of credit.

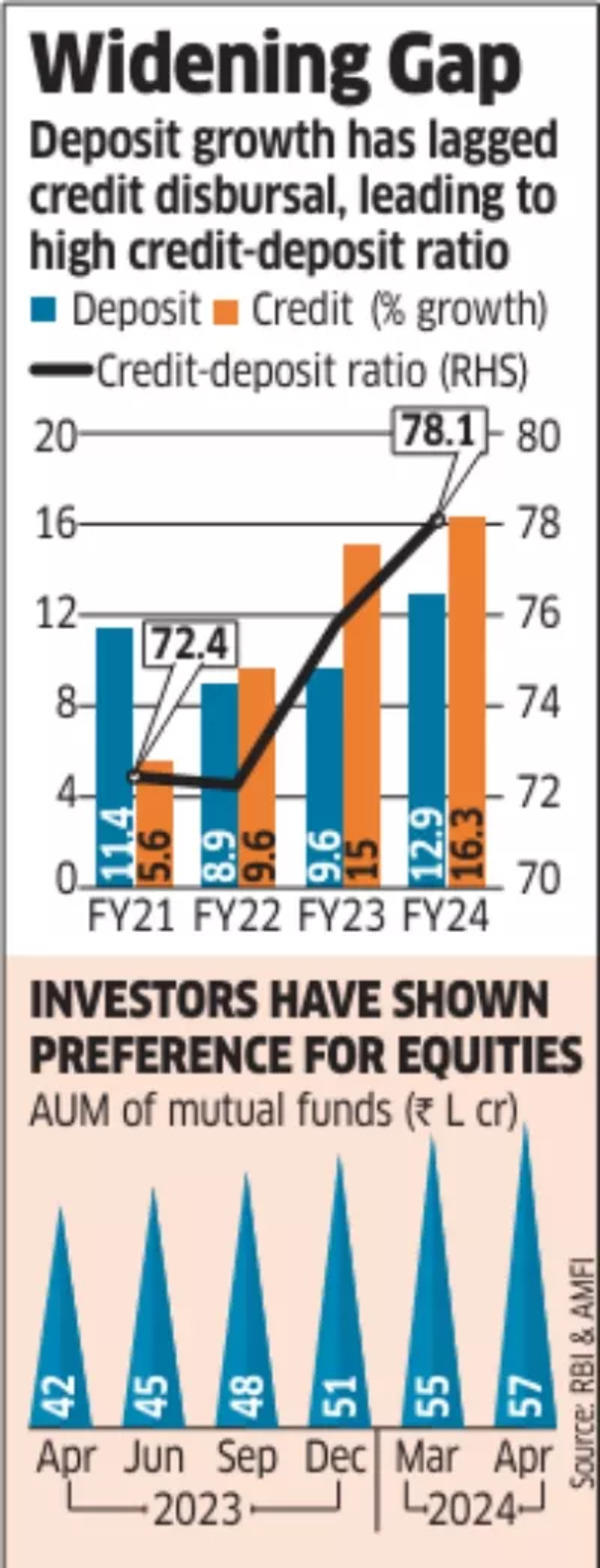

According to an ET report, during FY24, the growth in bank deposits lagged behind the rise in credit, compelling banks to rely on costlier Certificates of Deposit (CDs) to close the funding gap.

Banks have informed senior government officials about the slowdown in deposit growth. “One suggestion is that the lock-in period for

tax-saving fixed deposits

should be reduced to three years from five years,” a senior bank executive was quoted as saying.

Bankers have pointed out that investors are favoring equities,

mutual funds

, and tax-saving equity-linked savings schemes (ELSS), thanks to their impressive returns. These alternatives also have a five-year lock-in period.

Banks Deposit Growth Lags

Reducing the lock-in period for tax-saving fixed deposits to three years could help address this imbalance, according to bankers.

In FY24, aggregate deposits grew by 12.9%, while bank credit rose by 16.3%. This shift is attributed to investors seeking other options for their money.

The proportion of deposits in the gross financial savings of households declined from 6.2% of gross national disposable income (GNDI) in FY21 to 4% in FY23. During the same period, investment in shares and debentures increased from 0.5% to 0.8%.

“Because of the exuberance in the Indian stock markets, investors have tilted more towards the same. This has an impact on deposit growth,” another bank executive said.

Also Read | Home Loan Money Saving Tip: How to repay a Rs 50 lakh home loan in less than 10 years

Data from the Association of Mutual Funds in India (AMFI) shows that the industry’s assets under management (AUM) have more than doubled, from Rs 24.79 lakh crore on April 30, 2019, to Rs 57.26 lakh crore on April 30, 2024.

Banks argue that a healthy credit-deposit (CD) ratio is crucial for supporting the economy and funding large infrastructure projects. According to recent data, the CD ratio has been hovering around 80% since September 2023, up from 75.8% in FY23.