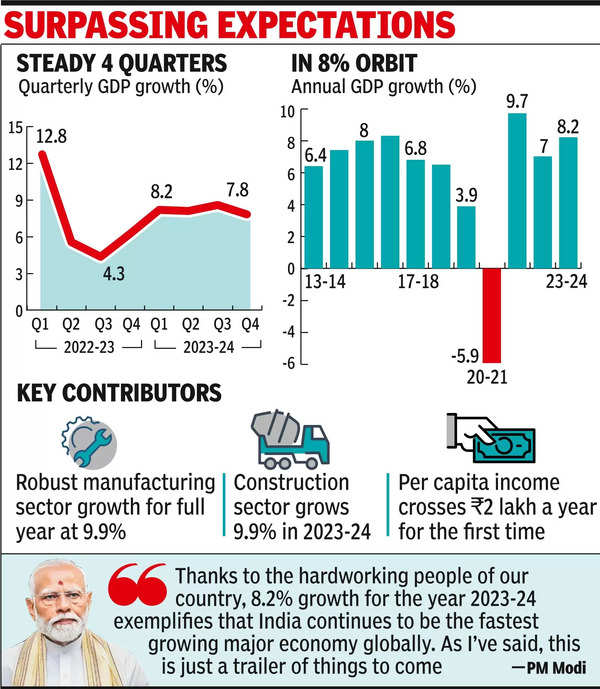

NEW DELHI: India’s economy is estimated to have grown by 8.2% in 2023-24, led by a solid expansion in manufacturing and construction sectors, and a strong push from Jan-March quarter growth, beating expectations and laying a robust foundation for the new govt, which assumes office this month after the polls. The strong numbers will help govt push reforms to sustain rapid expansion against the backdrop of global challenges.

Data released by National Statistical Office (NSO) Friday showed the economy grew 7.8% in Jan-Mar quarter, slower than the upwardly revised 8.6% in Oct-Dec period but above the 6.2% recorded in fourth quarter of the previous fiscal year.

This helped push growth to 8.2%, higher than the second advance estimate of 7.6%. This is higher than most estimates and above RBI’s 7% projection.

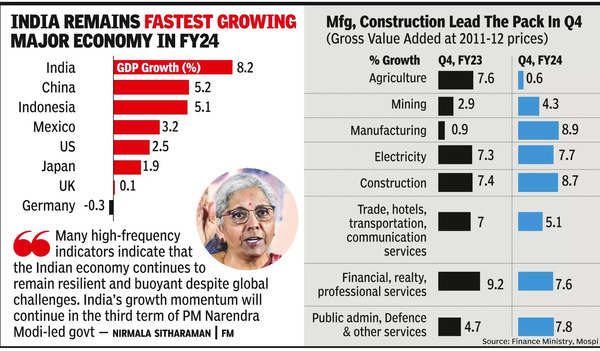

The strong growth numbers will help India retain the fastest growing major economy tag.

“The Q4

GDP growth

data for 2023-24 shows robust momentum in our economy which is poised to further accelerate,” PM Modi posted on X, asserting this was “a trailer of things to come”.

Finance minister

Nirmala Sitharaman

said many high frequency indicators indicate the Indian economy continues to remain resilient and buoyant despite global challenges. “India’s growth momentum will continue in the third term of Modi-led govt,” Sitharaman, who completed five years as FM on Friday, wrote on X.

The latest growth numbers come close on the heels of global ratings agency S&P revising India’s sovereign rating outlook to positive from stable citing robust growth and improving quality of govt spending.

The economy, Asia’s third largest, has recovered swiftly after Covid-19 led by robust domestic demand despite geopolitical challenges. Recovery in rural demand and prospects of a good monsoon augur well for growth in the months ahead. Govt analysis shows domestic economic activity remains resilient, backed by strong investment demand and upbeat business and consumer sentiments. Strong corporate and bank balance sheets and govt’s continued capex push should also help.

The data showed that the manufacturing sector grew by 9.9% in FY 24 compared to a contraction of 2.2% in the previous fiscal year while construction rose an annual 9.9% in 2023-24 after a growth of 9.4% in the previous year. The overall growth in the industry sector was 9.5% in FY24, sharply higher than the 2.1% in the previous fiscal year. The services sector, which accounts for more than 55% of the economy, grew by 7.6% in 2023-24, slower than the 10% in the previous year. The farm sector remained a worry with a growth of 1.4% in 2023-24, lower than the 4.7% in the previous year. The Jan-Mar quarter numbers also signalled some worry with a growth of 0.6% during the period, slightly higher than the 0.4% expansion in the third quarter. The data showed private and govt consumption remained soft during the year compared to the previous year.

“On the expenditure side, as expected, the growth has been mainly led by govt’s strong capex. A strong uptick in overall export growth, along with moderation in import growth, also supported the growth momentum in the fourth quarter. However, the concerning aspect is that the private consumption growth has remained feeble,” said Rajani Sinha, chief economist at ratings agency Care Edge.

“Going forward, we expect GDP growth at around 7% for FY25. Consumption trend is likely to improve as rural consumption improves with a normal monsoon. Moderation in food inflation would also be critical for a broad-based improvement in consumption trend. Upswing in the private investment cycle would be contingent on a sustained improvement in domestic consumption and global growth outlook,” said Sinha.

Govt sources highlighted several risks. They said geopolitical tensions pose substantial downside risks. Divergence of monetary easing paths of major central banks adds to policy uncertainty.

“Frequent and overlapping adverse climate shocks pose key upside risks to the outlook on international and domestic food prices. However, efforts of govt and the RBI have supported an encouraging trajectory of aligning inflation to the target on a durable basis,” sources said.