NEW DELHI: India should include an annual

wealth tax

and an

inheritance tax

for those with net wealth exceeding Rs 10 crore, equivalent to top 0.04 per cent of adult population, who currently hold over a quarter of the total wealth, a new paper has suggested.

The paper by the

World Inequality Lab

has proposed a comprehensive tax package on ultra-wealthy to tackle what it called the massive concentration at the very top of the wealth distribution and create valuable fiscal space for crucial social sector investments.

It called for raising phenomenally large tax revenues, while leaving 99.9 per cent of adults unaffected by the tax.

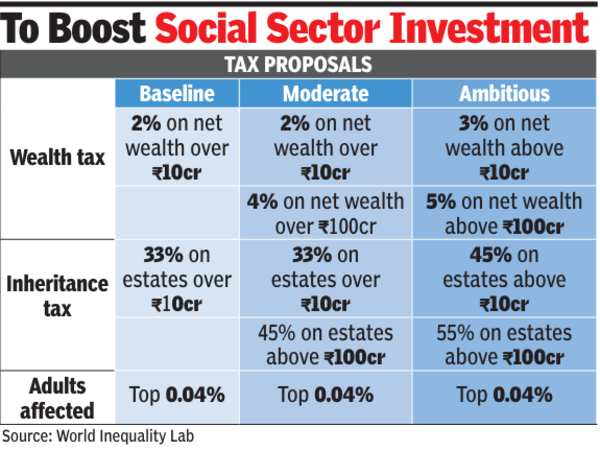

“In a baseline scenario, a 2 per cent annual tax on net wealth exceeding Rs 10 crore and a 33 per centinheritance tax on estates exceeding Rs 10 crores in valuation would generate a massive 2.7 per cent of gross domestic product (GDP) in revenues,” according to the paper authored by Thomas Piketty, Nitin Kumar Bharti, Lucas Chancel and Anmol Somanchi.

The paper said the package would need to be accompanied by explicit re-distributive policies to support the poor, lower castes and middle classes. “For example, baseline scenario would allow nearly doubling the current public spending on education, which has stagnated at 2.9 per cent of GDP over past 15 years, well below – less than half – 6 per cent target set by govt’s own National Education Policy 2020 (NE),” it said.

The issue of inheritance tax and redistribution of wealth has emerged as a raging topic with the BJP and main opposition party Congress sparring over the matter.