Apple

encountered an unexpected hurdle shortly after launching two company-owned stores in India in April of the previous year – a significant number of customers preferred to pay in cash. This development led the iPhone manufacturer to install currency note counting machines in both its Mumbai and Delhi stores.

Individuals familiar with the matter told ET that

cash payments

account for 7-9% of the American company’s sales in its two Indian stores, a stark contrast to the less than 1% or even zero cash transactions in its US or European outlets.

Customers continue to flock to the stores with bundles of cash to purchase mobile phones or computers.

It comes as no surprise that Quora, a social question-and-answer website, is inundated with inquiries from consumers regarding the possibility of making cash payments at Apple stores in India, sources told ET. One of the individuals, who wished to remain anonymous, noted that the proportion of customers purchasing Apple products with cash is higher in the Delhi store compared to the Mumbai store.

Currency in circulation

The two stores in India have a direct reporting line to the Apple retail team in the US, rather than to the

Apple India

sales operations. Their sales are also included in the global financial records.

Apple, however, is not the only company grappling with cash payments in India. The government has implemented a cash transaction limit of Rs 2 lakh per person per transaction, per day, or per event and occasion since 2017. This measure aims to encourage

digital payments

and curb black money.

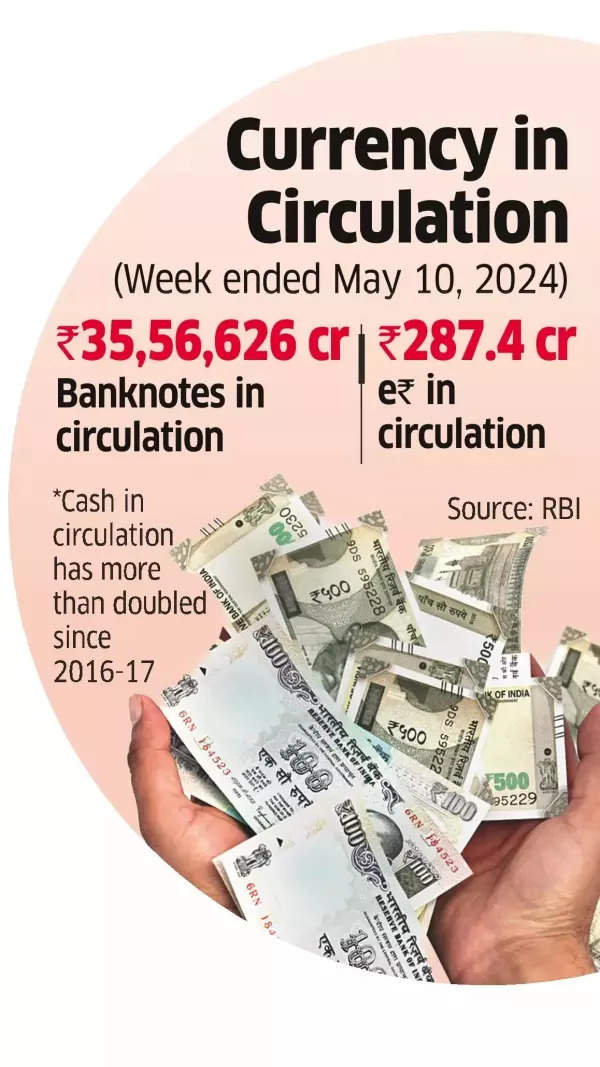

The amount of cash circulating in India has seen a significant increase, rising from Rs 13.35 lakh crore in March 2017 to Rs 35.15 lakh crore in March 2023, as reported by ET last month.

This growth highlights the continued importance of cash as a means of transaction, despite the substantial increase in digital payments through Unified Payments Interface (

UPI

), which reached Rs 19.64 lakh crore at the end of April 2023, up from Rs 2,425 crore in March 2017, according to data from the National Payments Corporation of India.

Also Read | 5 lakh ‘Apployments’: Apple ecosystem to create huge number of jobs in 3 years; iPhone maker may move half its supply chain from China to India

The Federation of Automobile Dealers Associations (FADA) estimates that between 15% and 20% of car purchases in India are self-funded, with buyers paying up to Rs 2 lakh in cash upfront, even for luxury vehicles. The remaining balance can be paid through various methods, including account payee cheques, bank drafts, electronic clearing systems, net banking, or debit cards.

Mercedes-Benz

India, a German luxury carmaker, has observed that cash and self-funded purchases account for a higher share of 25% in Mumbai and Bengaluru, compared to 15% in other markets across the country.

Santosh Iyer, managing director of Mercedes Benz India, was quoted as saying, “Almost 20% of the customers opt for an all-cash purchase.” An anonymous car dealer in Delhi expressed their frustration when a buyer wanted to purchase a super luxury car entirely with cash.

Manish Raj Singhania, president of FADA, explains that many customers prefer not to avail financing options to avoid paying interest and instead choose to pay in full using their savings.

Some buyers may not have the necessary documents, such as income tax returns, to secure a bank loan or may not be considered credit-worthy. These buyers, present in both rural and urban markets, make payments using a combination of cash (up to the government-regulated limit of Rs 2 lakh), cheques, and real-time gross settlement (RTGS) funds transfers between bank accounts.