MUMBAI: Two years ago, people laughed off the concept of

quick commerce

or instant deliveries. Some even asserted that consumers do not need products in 10-15 minutes.

Today, however, quick commerce is fast becoming ubiquitous for many

millennial

and

Gen Z

households. Companies have moved beyond

groceries

to deliver items ranging from fans and T-shirts to jewellery and iPhones.

In a recent note, Goldman Sachs said Blinkit’s implied valuation – estimated at $13 billion – is now higher than that of parent Zomato’s core food delivery business, indicating the rapid growth of the segment. Though still largely a metro play,

Q-commerce

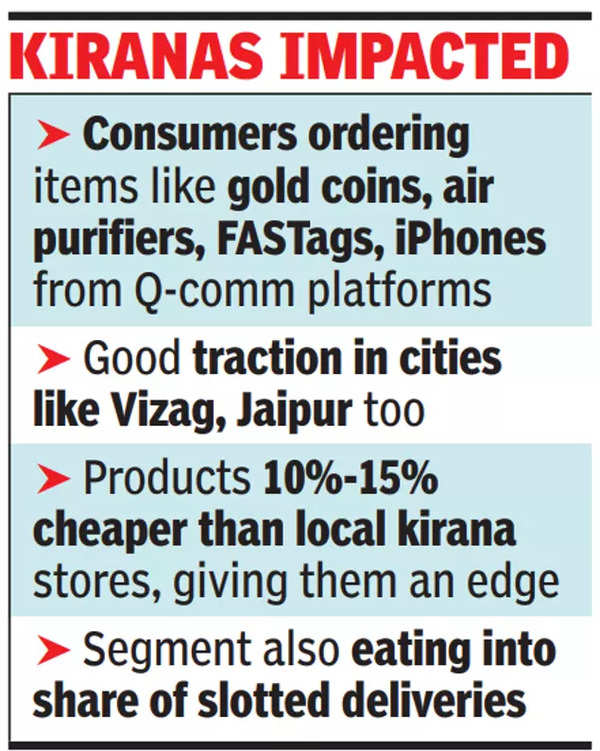

is finding takers in cities like Vizag, Nagpur, Kochi, Jaipur and Lucknow, executives at Swiggy Instamart and BigBasket told TOI.

‘Q-commerce accounts for 50% of online grocery market’

In the past one year, half the new customers that we have added are all pure play quick commerce customers, who often do not make planned purchases and end up buying 4-15 times a month from our platform,” said Seshu Kumar Tirumala, chief buying and merchandising officer at BigBasket.

For IPO-bound Swiggy, growth of Instamart in non-metros like Jaipur and Kochi has more than doubled in the past 12 months. “Given the wide array of products, we are seeing good traction in both metros and non-metros,” said Phani Kishan, CEO, Swiggy Instamart.

According to analysts, a share of grocery spends in the top 7-8 cities may be moving from local kirana stores to quick commerce.

“Incremental purchases solely cannot justify the growth of quick commerce. Some parts of offline purchases and scheduled online deliveries have moved to the segment. The platforms are also getting sales from impulse purchases which will not go to kirana stores,” said Satish Meena, advisor at market research firm Datum Intelligence.

With platforms like Zepto, Swiggy Instamart and Blinkit expanding into categories like beauty and personal care (BPC), toys, electronics, stationery items, a percentage of e-commerce sales is bound to get impacted. At present, non-grocery items account for about 15%-20% of quick commerce purchases.

“If consumers can get a toy or a BPC item on a quick commerce platform instantly, they won’t wait for Amazon and Flipkart to deliver it to them. That is why players like Flipkart have started working on the quick commerce model,” Meena said. “Consumers have been ordering everything, from gold coins during the festive season to air purifiers, FASTags, headphones, toys and more,” said Kishan.

Goldman Sachs estimates the size of the online grocery market, in terms of gross order value (GOV), to be about $11 billion as of FY24. Of this, quick commerce already makes up 50% or $5 billion. Q-commerce platforms have also been able to price products about 10%-15% cheaper than local kirana stores, giving them an edge in the game. “Given the scale of platforms such as Blinkit, they are able to get pricing/sourcing advantage from manufacturers,” said analysts at the firm.

“We want to become an attractive option even when compared to the best discount grocers in the offline space. If we can give consumers access to better prices and 10-minute deliveries, why won’t they buy from Zepto?” co-founder and CEO Aadit Palicha had told TOI earlier.

In terms of wallet share, quick commerce potentially accounts for 5%-6% of a household’s grocery spends.